The Escrow Process

This section will provide you with a better understanding of the escrow process, including

the following information:

What is Escrow?

What Does Escrow Do?

What Does the Escrow Holder Do?

What Does the Escrow Holder Not Do?

What is the Life of an Escrow?

What is Escrow?

Escrow is a process that provides for a fair and equitable transfer of property between a buyer and a seller whereas both parties to the real estate transaction entrust legal documents and various funds to the escrow holder. The escrow holder in turn has the responsibility of seeing that all the terms and conditions of escrow are carried out before the transfer of any funds or property are exchanged.

Using escrow as a neutral third party, both buyer and seller are assured that all mutually agreed to terms are met before the transaction is completed therefore minimizing the risk.

What Does Escrow Do?

Escrow is a neutral third party that carries out written instructions given by the principals.

This includes:

- Receiving funds and documents necessary to comply with the instructions

- Completing or obtaining required forms

- Handling final delivery of all items to the proper parties upon the successful completion of escrow

Escrow must be provided with all the necessary information to close the transaction.

This information may include, but is not limited to, the following:

- Loan documents

- Tax statements

- Fire and other insurance policies

- Title insurance policies

- Terms of sale and any seller-assisted financing

- Requests for payment for various services to be paid out of escrow funds

What Does the Escrow Holder Do?

The following items represent a typical list of what an escrow holder does:

- Serves as a neutral third party and the vehicle by which the mutual instructions of all parties are carried out

- Prepares escrow instructions

- Requests a preliminary title search to determine the present condition of title to the property

- Requests a beneficiary’s statement if debt or obligation is to be taken over by the buyer

- Complies with lender’s requirements, specified in the escrow agreement

- Receives purchase funds from the buyer

- Prepares or secures the deed or other documents related to escrow

- Prorates taxes, interest, insurance, and rents according to instructions

- Secures releases of all contingencies or other conditions as imposed on any particular escrow

- Instructs title to record documents at the County Recorder’s Office

- Closes escrow when all the instructions of buyer and seller have been carried out

- Requests issuance of the title insurance policy

- Disburses funds as authorized by instructions, including charges for title insurance, recording fees, real estate commissions and loan payoffs

- Prepares final statements for the parties accounting for the disposition of all funds deposited in escrow (these are useful in the preparation of tax returns)

What Does the Escrow Holder Not Do?

- Offer legal advice

- Negotiate the transaction

- Offer investment advice

When all instructions in the escrow have been carried out, the closing can take place. At this time all outstanding funds are collected and fees, such as title insurance premiums, real estate commissions and termite inspection charges, are paid. Title to the property is then transferred under the terms of the escrow instructions and appropriate title insurance is issued.

What is the Life of an Escrow?

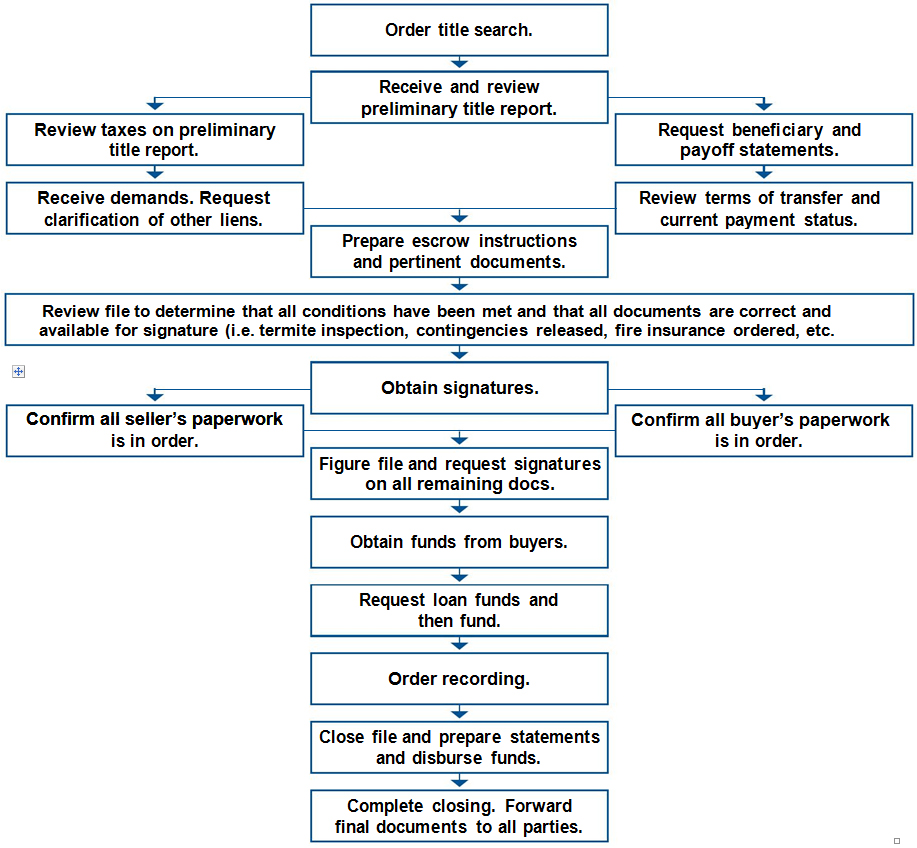

Below is a rough outline of an escrow officer’s responsibilities to complete each escrow. Once the transaction is in contract, the contract serves as instructions for the escrow officer. Escrow insures that all title and lender requirements have been met. Escrow includes depositing funds, documents and instructions necessary to complete the transaction.

Review file to determine that all conditions have been met and that all documents are correct and available for signature (i.e. termite inspection, contingencies released, fire insurance ordered, etc.

Disclaimer-This flyer is for informational purposes only and not to be construed as legal or tax advice. The primary aim is to help real estate agents and mortgage loan professionals with information that helps them conduct their business. Before making any decisions dealing with the subject matter found in this flyer, we recommend you seek out specific advice from a legal or tax professional.

310.873.4188

310.873.4188