This section will help you to understand the closing process and what to expect at the

closing appointment:

What Will You Need at the Closing/Signing Appointment?

What Happens at the Closing/Signing Appointment?

Who Pays What?

What is Sub Escrow?

What is Payoff?

What are Good Funds Policies?

What are Supplemental Property Taxes?

What Will You Need at the Closing/Signing Appointment?

When you sign the documents that need to be notarized, you will need a valid photo identification. Your driver’s license is preferred, but passports and military ID should also suffice. You will also be asked to provide your Social Security number for tax reporting purposes.

What Happens at the Closing/Signing Appointment?

The escrow holder will contact you or your agent to schedule a closing or signing appointment, which constitutes nearing “the close of escrow”.

At the closing/signing appointment, you will be able to review the estimated closing statement and supporting documentation. This is your opportunity to ask questions and clarify terms. You should review the estimated closing statement carefully and report any discrepancies to the escrow officer.

The escrow company is obligated by law to have the designated amount of money before releasing any funds.

If you have any questions or foresee a problem, contact your escrow officer immediately.

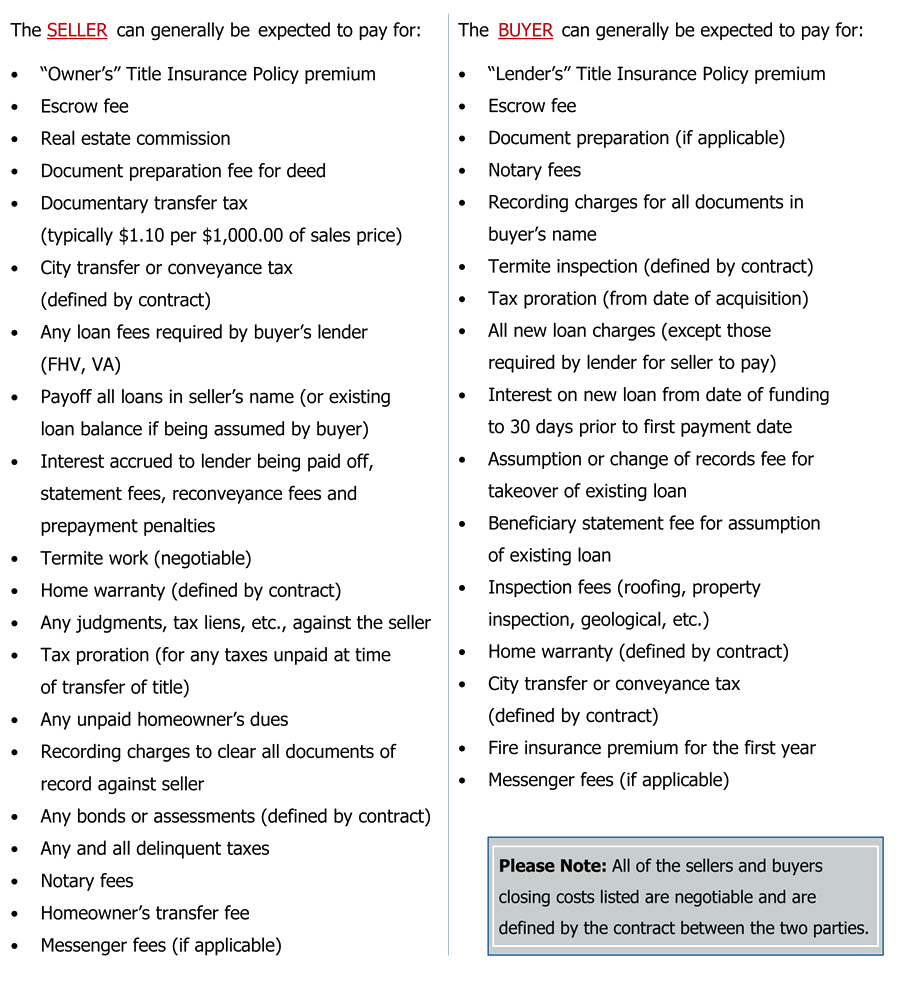

Who Pays What?

The SELLER can generally be expected to pay for:

- “Owner’s” Title Insurance Policy premium

- Escrow fee

- Real estate commission

- Document preparation fee for deed

- Documentary transfer tax

(typically $1.10 per $1,000.00 of sales price)

- City transfer or conveyance tax (defined by contract)

- Any loan fees required by buyer’s lender (FHV, VA)

- Payoff all loans in seller’s name (or existing loan balance if being assumed by buyer)

- Interest accrued to lender being paid off, statement fees, reconveyance fees and prepayment penalties

- Termite work (negotiable)

- Home warranty (defined by contract)

- Any judgments, tax liens, etc., against the seller

- Tax proration (for any taxes unpaid at time of transfer of title)

- Any unpaid homeowner’s dues

- Recording charges to clear all documents of record against seller

- Any bonds or assessments (defined by contract)

- Any and all delinquent taxes

- Notary fees

- Homeowner’s transfer fee

- Messenger fees (if applicable)

The BUYER can generally be expected to pay for:

- “Lender’s” Title Insurance Policy premium

- Escrow fee

- Document preparation (if applicable)

- Notary fees

- Recording charges for all documents in buyer’s name

- Termite inspection (defined by contract)

- Tax proration (from date of acquisition)

- All new loan charges (except those required by lender for seller to pay)

- Interest on new loan from date of funding to 30 days prior to first payment date

- Assumption or change of records fee for takeover of existing loan

- Beneficiary statement fee for assumption of existing loan

- Inspection fees (roofing, property inspection, geological, etc.)

- Home warranty (defined by contract)

- City transfer or conveyance tax (defined by contract)

- Fire insurance premium for the first year

- Messenger fees (if applicable)

What is Sub Escrow?

Sub Escrow Service is provided in connection with an order for title insurance where the title company is providing a disbursement service in support of a primary escrow agent, other than the title company. Progressive Title Company pays off existing loans and liens with funds made available through new loans or deposits to the transaction.

Title companies provide this service so that funds are received, documents are recorded, the transaction is closed and money is delivered to payoff existing lenders and lien holders as expeditiously as possible. This process is labor and time intensive.

Local custom, county and state rules and regulations, together with time differences between west coast and east coast financial institutions, all come into play.

Here are a few of the components included in our Sub Escrow Service:

- Requirement that the instructions of the primary escrow agent and any lender that is being insured be followed to the letter.

- Delivering funds to lien holders in order to place title in the condition called for in the agreement between the seller, buyer and/or lender.

- Delivering funds to primary escrow holder as is required in the transaction. Progressive Title Company’s Sub Escrow Service permits timely recorded documents and delivery of existing lender payoff money and seller’s proceeds to the primary escrow holder in the least amount of time possible.

What is Payoff?

A Sub Escrow (loan payoff) is an extremely important service provided by title companies to facilitate the handling of money in the closing of a real estate transaction.

The title company’s performance of the payoff function, exclusive of escrow services, is unique to Southern California. The majority of title orders require payoff service. The title company’s Sub Escrow department does not draw escrow instructions or documents (i.e. Grant Deeds, Trust Deeds, etc.); it only performs payoff services.

The Sub Escrow Department does not order demands for payoff; escrow does; but the Sub Escrow Department does make the payoffs at the close of escrow. Sub Escrow has a language of its own—The following brief definitions of commonly used terms are intended to answer some of the questions you may have regarding the Sub Escrow (payoff) function.

PAYOFF

The receipt of funds from the buyer and the payment of the obligations of the seller in conjunction with a real estate transaction. The payoff function is performed by the title company.

PAYOFF FEE

Progressive Title Company’s fee for handling a payoff varies slightly from county to county. The fee is strictly a processing charge and does not cover special handling charges or potential shortages.

PREFIGURES

Estimated payoff figures are calculated and given to escrow prior to closing upon request. These figures are only valid through the date given and are based on the information received at that time.

GOOD FUNDS

Progressive Title Company must be in receipt of “Good Funds” prior to disbursing on a payoff.

Types of “Good Funds” include:

- Funds wired into an Progressive Title Sub Escrow account.

- A cashier’s check drawn on an FDIC insured bank will receive next day availability after deposit.

TAXES

Outstanding property taxes may be paid out of the payoff process by the title company’s Sub Escrow Departments.

DEMANDS

Demands for payoff are the written request for payment from the lending institution and must include specific payoff information concerning the particular property and must be signed. It is the responsibility of the escrow company to timely order and provide all necessary demands including any updates or changes.

REFUNDS

Lenders no longer send refunds to title companies; all refunds are sent directly to the borrower so it is important that the borrowers call the lender to give them or verify home address.

SHORTAGES

If there is a shortage of funds necessary to cover the outstanding obligations, the shortage funds must be received prior to closing.

DISBURSEMENT CHECKS

Checks are delivered next day delivery via UPS or GSO per the demands instructions.

WIRE TRANSFERS

Funds may be wired into or out of a Progressive Title Sub Escrow account if so instructed.

OUT OF COUNTY TRANSACTIONS

Progressive Title Company may receive and disburse payoff funds through any of our offices.

What are Good Funds Policies?*

The California State Law requires that checks be deposited prior to disbursement. In addition, the actual day we disburse funds is governed by the type of funds we have deposited into our account.

We intend to follow the disbursement schedule of the “Good Funds Law” and the guidelines set forth by our underwriters. We will be able to do the following:

- Disbursement of funds the same day as our deposit, if we have received:

- Wired funds (we must verify receipt by our bank).

- Disbursement of funds the next day following the day of deposit if we have received:

- Cashier’s checks (must come from FDIC institutions or NCUA insured Credit Unions).

- Official/certified checks (must come from FDIC institutions or NCUA insured Credit Unions).

- Disbursement of funds three days after the date of deposit if we have received:

- Checks where customer banks with our bank (Comerica).

- Disbursement of funds 10 days after the date of deposit if we have received:

- Checks where customer banks outside of Comerica.

(example: deposit received on 02/09/15, released on 02/20/15)

Recording at 8:00 AM:

Our 8:00 AM recordings will continue to require the funds be deposited the evening before recording. In most instances, we will be able to disburse our funds the day of recording.

Special Recording:

In Counties that Allow Special Recordings:

Funds will be deposited on the day received, and funds will be disbursed on the day following confirmation of the special recording, unless funds were received at least one day prior to the special recording, or by wire or cashiers/certified check.

Note: Disbursement by wire has a deadline of 2 PM Pacific Standard Time.

Section 23413.1 et seq. of the California Insurance Code

*Per California State Law and Progressive Title Company Policy

What are Supplemental Property Taxes?

As a new homeowner, you may receive a supplemental tax bill from your County Tax Assessor. The reason being, at the time of closing, tax prorations are assessed at the sellers current tax rate. The new owner’s assessed tax value may be higher, therefore, you would receive a supplemental tax bill to compensate between the two assessed values.

Q. When Did this Tax Come into Effect?

The supplemental Real Property Tax Law was signed by the Governor in July of 1983, and is part of an ambitious drive to aid California’s schools. This property tax revision is expected to produce over $300 million per year in revenue for schools.

Q. How Will Supplemental Property Tax Affect Me?

If you don’t plan on buying new property or undertaking new construction, this new tax will not affect you at all. But if you do wish to do either of the two, you will be required to pay a supplemental property tax, which will become a lien against your property as of the date of ownership change or the date of completion of new construction.

Q. When and How Will I be Billed?

“When” is not easy to predict. You could be billed in as few as three weeks, or it could take over six months. “When” will depend on the individual county and the workload of the County Assessor, the County Controller/Auditor and the County Tax Collector. The Assessor will appraise your property and advise you of the new supplemental assessment amount. At that time you will have the opportunity to discuss your valuation, apply for a Homeowner’s Exemption and be informed of your right to file an Assessment Appeal. The County will calculate the amount of the supplemental tax bill. The supplemental tax bill will identify, among other things, the following information: the amount of the supplemental tax and the date on which the taxes will become delinquent.

Q. How Will the Amount of My Bill be Determined?

There is a formula used to determine your tax bill. The total supplemental assessment will be prorated based on the number of months remaining until the end of the tax year, June 30.

Q. Can I Pay My Supplemental Tax Bill in Installments?

All supplemental taxes on the secured roll are payable in two equal installments. The taxes are due on the date the bill is mailed and are delinquent on specified dates depending on the month the bill is mailed, as explained below:

- If the bill is mailed within the months of July through October, the first installment shall become

delinquent on December 10th of the same year. The second installment shall become delinquent on April 10th of the next year.

- If the bill is mailed within the months of November through June, the first installment shall become delinquent on the last day of the month following the month in which the bill is mailed. The second installment shall become delinquent on the last day of the fourth calendar month following the date the first installment is delinquent.

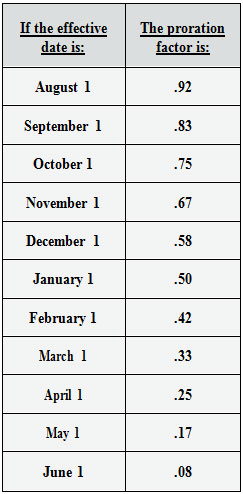

Q. Can You Give Me an Idea of How the Proration Factor Works?

The supplemental tax becomes effective on the first day of the month following the month in which the change of ownership or completion of new construction actually occurred. If the effective date is July 1st, then there will be no supplemental assessment on the current tax roll and the entire supplemental assessment will be made to the tax roll being prepared, which will then reflect the full cash value. In the event the effective date is not on July 1st, then the table of factors represented on the following panel is used to compute the supplemental assessment on the current tax roll. The County Auditor finds that the supplemental property taxes on your new home would be $1,000 for a full year. The change of ownership took place on September 15th with the effective date being October 1st: the supplemental property taxes would, therefore, be subject to a proration factor of .75 and your supplemental tax would be $750.

Q. Will My Supplemental Taxes be Prorated in Escrow?

No, unlike your ordinary annual taxes, the supplemental tax, is a one time tax which dates from the date you take ownership of your property or complete the construction until the end of the year on June 30th. The obligation for this tax is entirely that of the property owner.

310.873.4188

310.873.4188